Cannabis Credit Checks for Oregon Operators

Oregon has one of the most established and competitive cannabis markets in the country. With price compression, oversupply, and tight margins, unpaid invoices and extended payment terms are increasingly common.

If slow-paying customers or aging receivables are impacting your cannabis business, Cannabis Credit Reports helps you understand which companies have outstanding balances quickly to make better credit decisions.

TRUSTED BY LEADING OREGON CANNABIS-RELATED BUSINESSES

Why Oregon Cannabis Businesses Needs Better Credit Risk Visibility

Oregon’s cannabis industry is mature—but maturity has brought financial pressure. Intense competition and wholesale price compression have forced many operators to stretch payables to manage liquidity.

Oregon cannabis businesses are facing prolonged wholesale price compression, oversupply impacting margins, heavy reliance on vendor credit, net 30–90+ terms becoming standard and ncreased business closures and consolidations

In a margin-sensitive market like Oregon, extending credit without reliable payment data significantly increases risk exposure.

$215M+

OREGON A/R DATA

400 +

OREGON LICENSES IN OUR DATABASE

$17M+

OREGON DEBT COLLECTION DATA

$2BIL+

CURRENT TOTAL DATA IN OUR PLATFORM

HOW CCA HELPS YOU CHECK WHO PAYS AND WHO DOESN’T IN OREGON

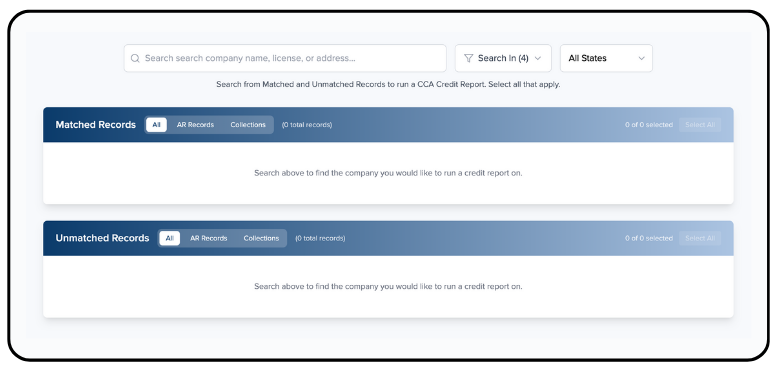

1. Search for a company to run a credit report

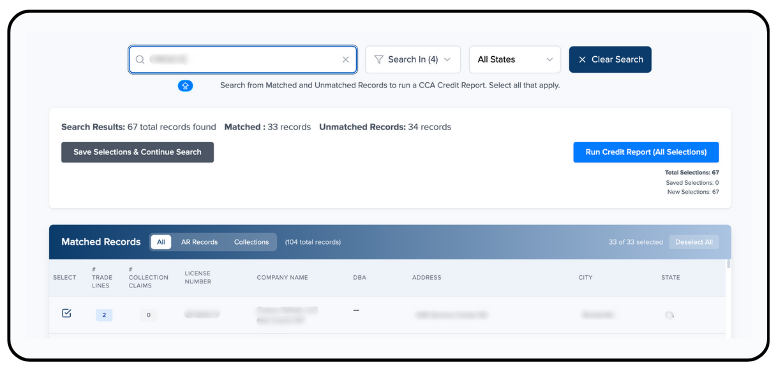

2. Select records and run the CCA report

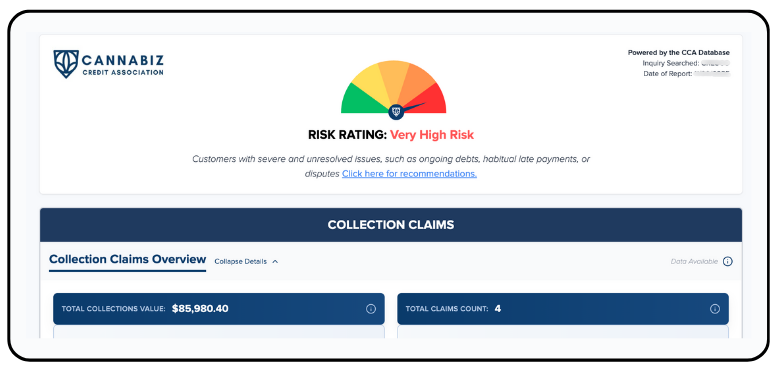

3. Check the cannabis company’s risk score

4. Review the company’s payment behavior

Why Credit Risk Is Rising in Oregon

Oregon’s competitive environment often forces operators to prioritize certain vendors while delaying others. This selective payment behavior can lead to growing receivables and unexpected losses.

Common supplier challenges include:

Invoices aging beyond 60 or 90 days

Partial payments with remaining open balances

Accounts entering collections after prolonged delinquency

Businesses restructuring or exiting the market

Vertically integrated operators stretching vendor terms

CCA provides early warning indicators so you can intervene before exposure escalates.

CCA identifies Oregon-specific red flags such as:

Repeated slow-pay patterns

Rapidly increasing outstanding balances

Accounts trending toward collections

License types showing elevated delinquency trends

Key Features & Benefits

Real-Time Cannabis Credit Checks

Run instant credit reports on any licensed Oregon cannabis operator.

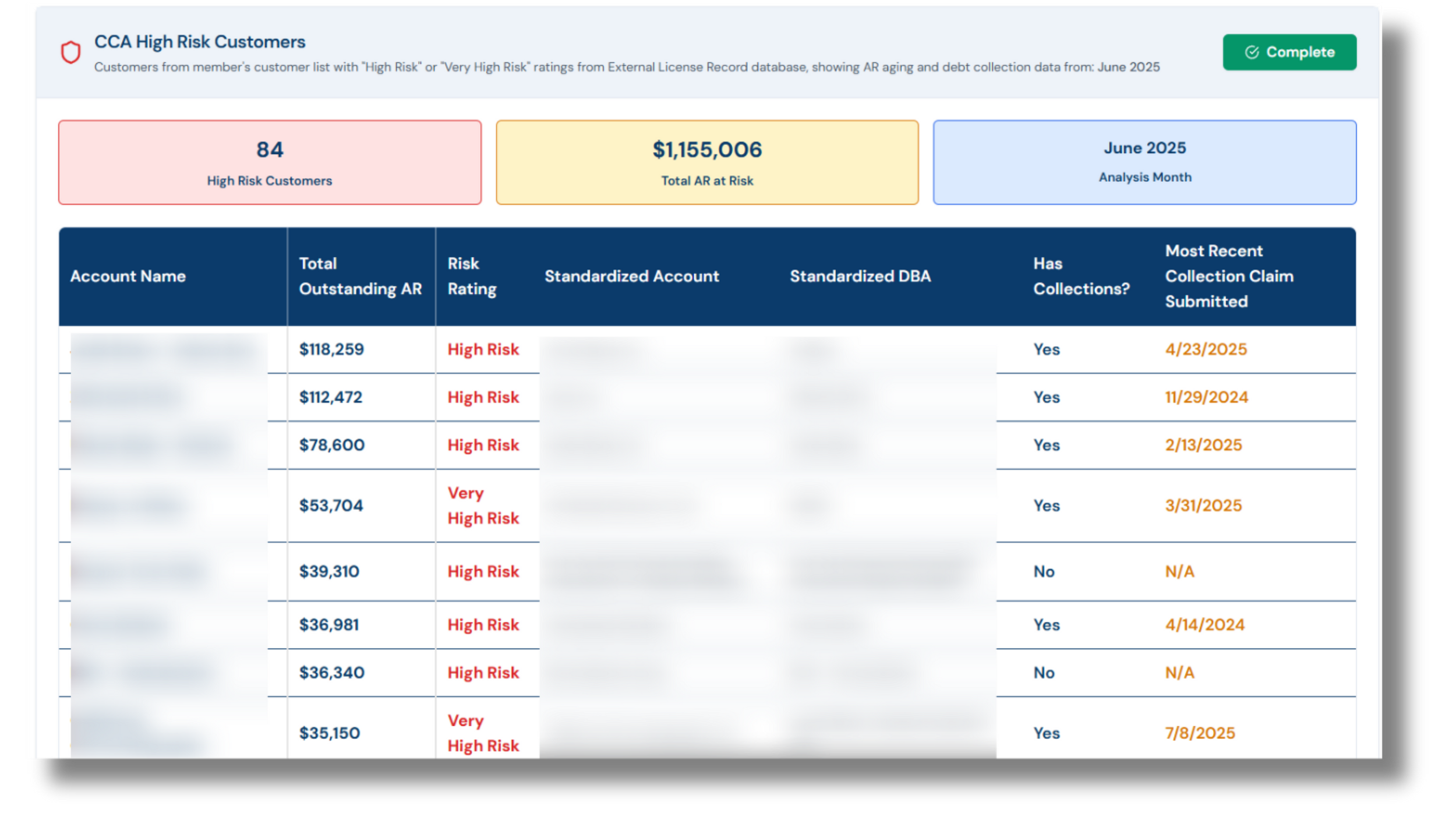

A/R Monitoring & Risk Alerts

Receive alerts when customer payment behavior deteriorates.

Oregon-Specific Credit Intelligence

Crowdsourced A/R data combined with verified recovery and partner insights.

Risk Analysis by License Type

Producers, processors, wholesalers, retailers, transporters, labs, and vertically integrated operators.

Team Access & Downloadable Reports

Unlimited users with exportable, shareable Oregon credit reports.

RUN

Credit checks on any Oregon operator.

MONITOR

Alert for flagged debtors, late pay trends, and worsening payment performance.

TRACK

30/60/90+ day aging patterns across the Oregon market.

COMPARE

Benchmark Oregon trends with national averages.

GET

React quickly to risk alerts with smarter credit limits

FAQs about the CCA and cannabis credit scoring in Oregon

-

Oregon’s oversupply and pricing pressures create unique payment behaviors. State-specific credit data shows how operators actually manage payables, helping you extend credit more safely.

-

Monitoring highlights early warning signs such as:

Aging moving into higher-risk brackets

Rising balances without consistent payments

Accounts entering collections

Sudden deterioration in payment patterns

This allows you to tighten terms or pause shipments before losses grow.

-

Oregon data is updated continuously through:

Member-contributed A/R submissions

Verified industry partner records

Active debt recovery placements

Real-time payment behavior signals

-

You can search any licensed cannabis operator in Oregon, including:

Cultivators

Manufacturers

Distributors

Retailers/dispensaries

Delivery companies

Microbusinesses

Testing labs

Vertical operators

If they hold a valid state license, you can run a credit check and monitor their AR risk.

-

Yes. All data is encrypted, anonymized, and handled in compliance with privacy and financial data regulations. No information is shared with the business being evaluated.

-

A full snapshot of an operator’s financial reliability, including:

License status

Risk score & indicators

Payment behavior

30/60/90+ aging

Collections alerts

It’s a real-world view of how operators pay not theoretical scores.

-

Once you become a member, the CCA credit reports are available instantly. Simply search the licensed operator on the platform, and you’ll see their real-time payment behavior, risk score, and financial signals immediately.

-

CCA empowers you to:

Evaluate creditworthiness before extending terms

Monitor customers for signs of distress

Predict slow-pay/no-pay patterns

Set smarter limits

Protect cash flow with real-time risk alerts