Cannabis Credit Checks for New York Operators

If you operate within New York’s cannabis industry and are dealing with unpaid invoices or extended payment delays, we help recover outstanding receivables efficiently and compliantly.

TRUSTED BY LEADING NEW YORK CANNABIS-RELATED BUSINESSES

Why New York Needs Better Credit Risk Visibility

New York’s cannabis market is one of the largest and most complex in the country. Rapid license issuance, social equity participation, and uneven retail rollout have created significant financial strain across the supply chain.

Today, New York cannabis operators face delayed store openings and uneven retail access, high startup and compliance costs, limited access to traditional financing, aggressive competition among wholesalers and heavy dependence on trade credit and extended terms

As Net 30–90+ terms become standard, payment reliability varies widely. Access to New York-specific cannabis credit intelligence is critical for reducing exposure and managing receivables proactively..

$113M+

NEW YORK A/R DATA

1,000 +

NEW YORK LICENSES IN OUR DATABASE

$3.5M+

NEW YORK DEBT COLLECTION DATA

$2BIL+

CURRENT TOTAL DATA IN OUR PLATFORM

HOW CCA HELPS YOU CHECK WHO PAYS AND WHO DOESN’T IN NEW YORK

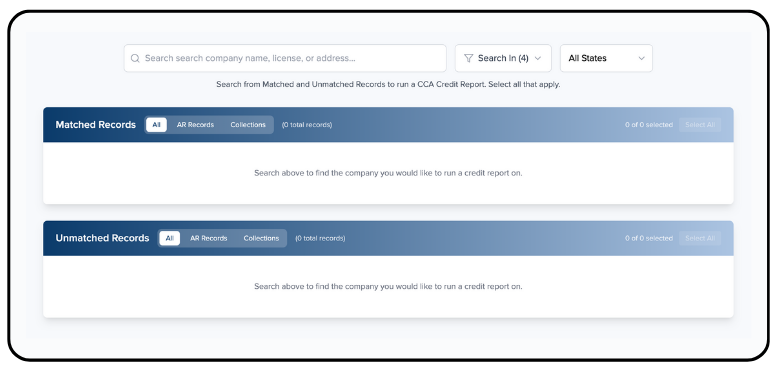

1. Search for a company to run a credit report

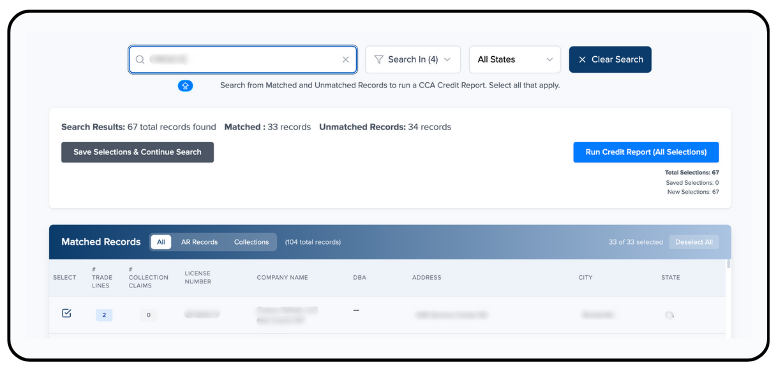

2. Select records and run the CCA report

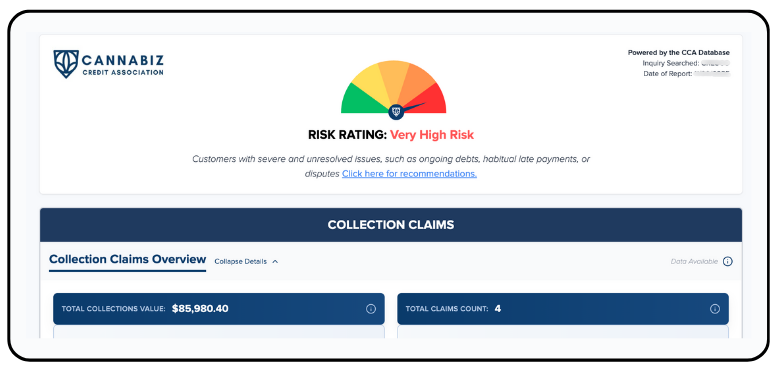

3. Check the cannabis company’s risk score

4. Review the company’s payment behavior

Why Credit Risk Is Rising in New York

New York’s cannabis industry is still stabilizing. Many operators are scaling operations before cash flow becomes predictable, leading to inconsistent payment behavior.

This environment has contributed to:

Slower invoice settlement cycles

Growing outstanding balances

Operators entering collections or restructuring

Payment volatility across license type

License transfers driven by financial distress

Early insight into accounts receivable risk allows suppliers and service providers to act before balances become uncollectible.

CCA helps identify red flags such as:

Repeated late-payment patterns

License categories with elevated default risk

Accounts trending toward collections

Aging extending beyond 60 and 90 days

Key Features & Benefits

Instant Cannabis Credit Checks

Run real-time credit checks on any licensed New York cannabis business.

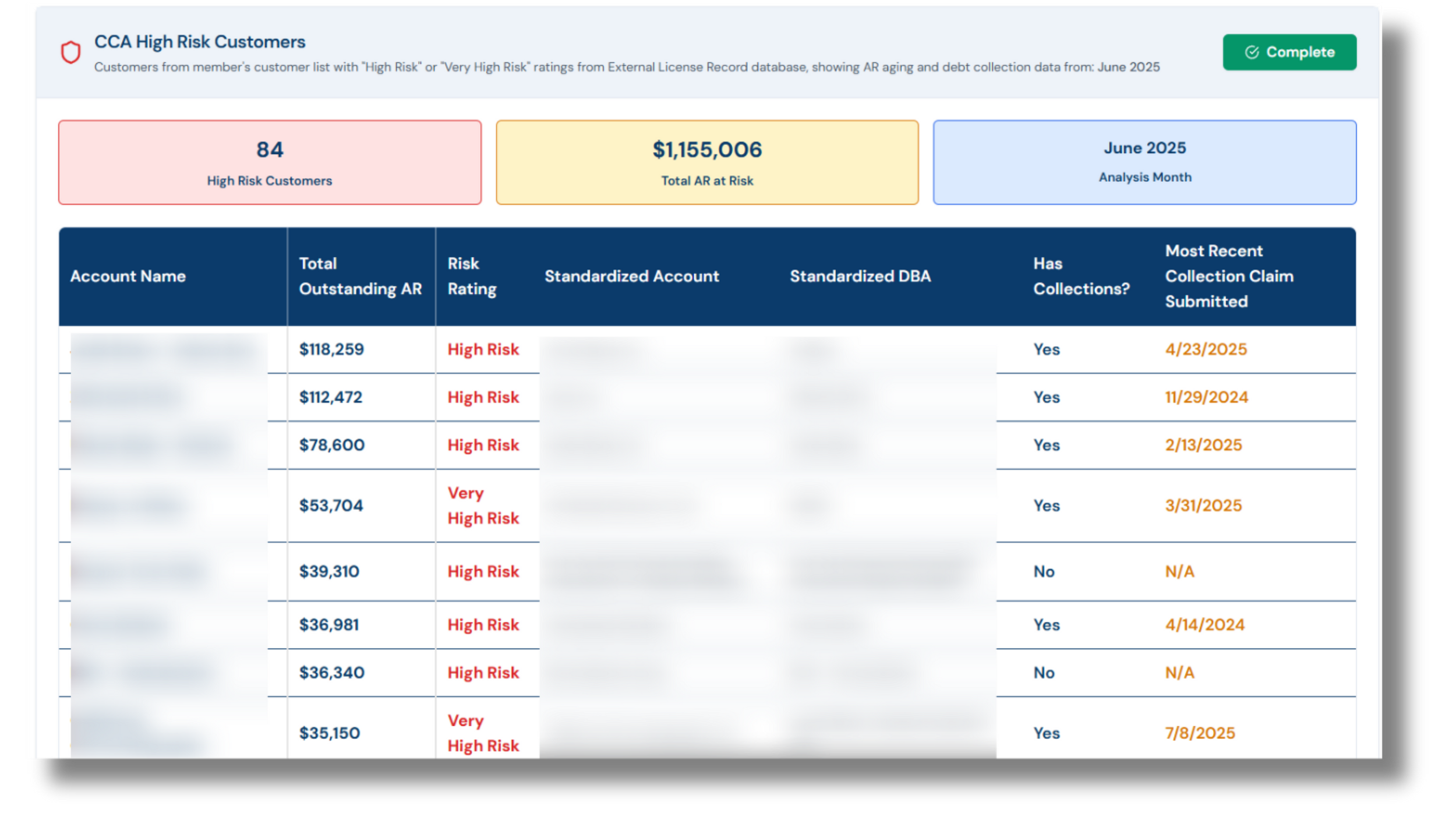

A/R Monitoring & Risk Alerts

Receive alerts when customer payment behavior worsens or risk levels increase.

New York-Focused Credit Dataset

Industry-driven A/R data combined with verified partner and recovery records.

Risk Tracking by License Type

Retail dispensaries, cultivators, processors, distributors, transporters, labs, microbusinesses, and vertically integrated operators.

Multi-User Access & Exportable Reports

Unlimited team seats with downloadable, shareable New York credit reports.

RUN

Credit checks on any New York operator.

MONITOR

Alert for flagged debtors, late pay trends, and worsening payment performance.

TRACK

30/60/90+ day aging patterns across the NY market.

COMPARE

Benchmark New York trends with national averages.

GET

React quickly to risk alerts with smarter credit limits

FAQs about the CCA and cannabis credit scoring in New York

-

New York’s regulatory structure, license mix, and rollout challenges create payment behaviors that differ from other states. NY-specific credit data reflects real payment history; not assumptions, so you can extend credit with confidence.

-

Monitoring alerts you to risk changes such as:

Aging moving into 60–90+

Increasing outstanding balances

Collections activity

Worsening payment timelines

These early warnings let you tighten terms or stop shipping before losses escalate.

-

CCA updates New York data continuously through:

Crowdsourced A/R submissions

Verified partner datasets

Active debt recovery records

Real-time payment behavior signals

-

You can search any licensed cannabis operator in New York, including:

Cultivators

Manufacturers

Distributors

Retailers/dispensaries

Delivery companies

Microbusinesses

Testing labs

Vertical operators

If they hold a valid state license, you can run a credit check and monitor their AR risk.

-

Yes. All data is anonymized, compliant, and securely processed. CCA does not share your AR data with competitors or the company you’re checking. The platform meets strict privacy and financial data protection standards, and no personally identifiable information is ever exposed.

-

A full snapshot of an operator’s financial reliability, including:

License status

Risk score & indicators

Payment behavior

30/60/90+ aging

Collections alerts

It’s a real-world view of how operators pay not theoretical scores.

-

Once you become a member, the CCA credit reports are available instantly. Simply search the licensed operator on the platform, and you’ll see their real-time payment behavior, risk score, and financial signals immediately.

-

CCA empowers you to:

Evaluate creditworthiness before extending terms

Monitor customers for signs of distress

Predict slow-pay/no-pay patterns

Set smarter limits

Protect cash flow with real-time risk alerts