Cannabis Credit Checks & AR Risk Monitoring for Michigan Operators

Instant credit insights, payment history, and real-time AR risk monitoring tailored to the Massachusetts cannabis market.

TRUSTED BY LEADING MICHIGAN CANNABIS-RELATED BUSINESSES

Why Michigan Matters

Michigan is one of the fastest-growing and most competitive cannabis markets in the Midwest. With evolving regulations, fluctuating wholesale prices, license saturation, and increasing use of trade credit, extending payment terms in Michigan comes with real financial risk.

Having Michigan-specific credit data and real payment history is essential to protect your receivables.

$258M+

MICHIGAN A/R DATA

2,000 +

MICHIGAN LICENSES TO 128 MEMBERS SHARING THEIR A/R

$13M+

MICHIGAN DEBT COLLECTION DATA

14.7%

OF MICHIGAN A/R IS 91+ DAYS PAST DUE

HOW CCA HELPS YOU CHECK WHO PAYS AND WHO DOESN’T IN MICHIGAN

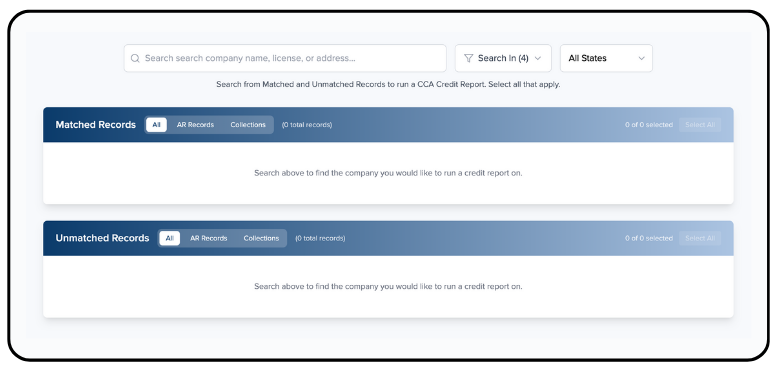

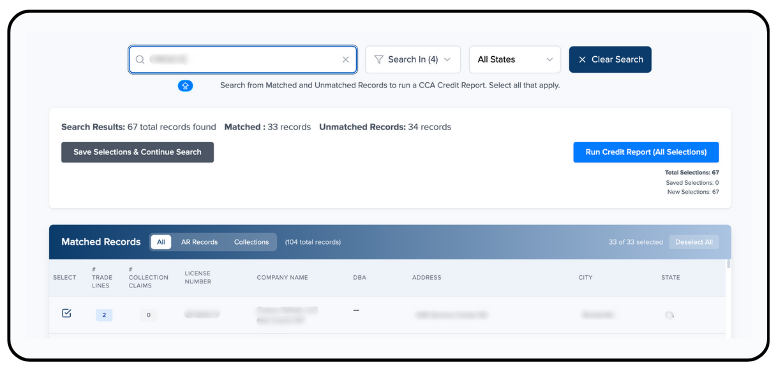

1. Search for a Michigan cannabis company

2. Select records and run your credit check

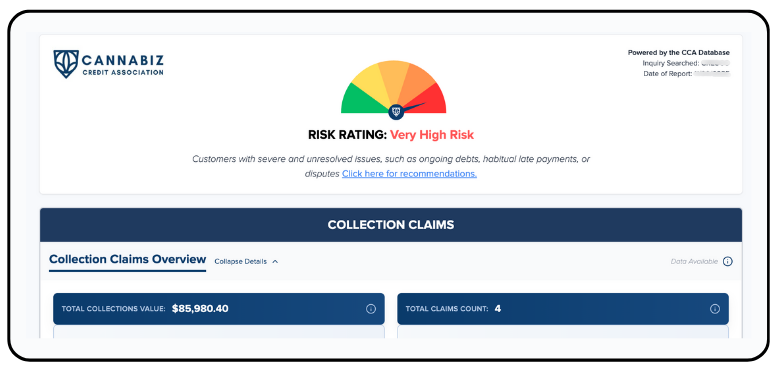

3. Check the cannabis company’s risk score

4. Review the company’s payment behavior

Why Credit Risk Is High in Michigan

Michigan’s cannabis market is experiencing rapid growthbut also rising payment delays, license turnover, and increased competition. Many operators rely heavily on Net 30–90+ terms, which exposes vendors to slow payments and unpaid invoices.

Early AR risk signals help you protect cash flow by identifying:

Late-pay and no-pay operators

Increasing debt levels

Companies moving toward collections

Unusual payment activity

High-risk license types

Features & Benefits

Real-time credit checks for licensed cannabis companies in Michigan

AR risk alerts and monitoring for slow-pay or no-pay Michigan operators

Crowdsourced debtor data from Michigan’s largest credit-tracking dataset

Track risk by Michigan license type (grower, processor, retailer, microbusiness, etc.)

Unlimited team access + downloadable credit reports

RUN

Cannabis credit checks on any licensed operator in Michigan

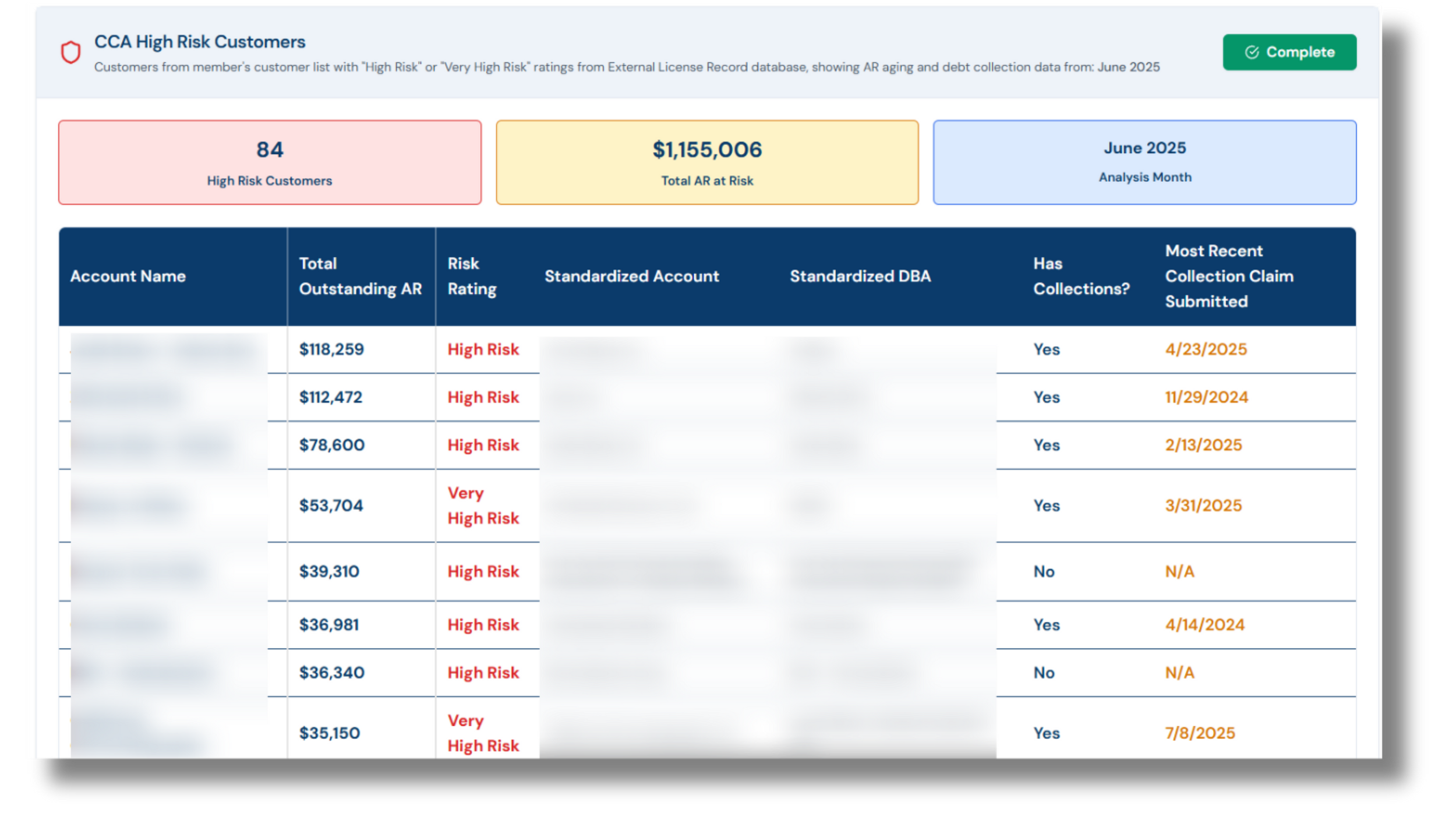

MONITOR

Flagged debtors and late-payment history unique to Michigan.

TRACK

30/60/90+ day aging patterns across the Michigan supply chain

COMPARE

Benchmark Michigan payment behavior against national data

GET

Alerts when a Michigan operator’s payment behavior changes

FAQs about the CCA and cannabis credit scoring in Michigan

-

Michigan has thousands of operators, varying financial stability, shifting prices, and frequent market changes. A Michigan-specific credit check helps you evaluate real payment history, reliability, and financial risk before offering credit. Thus, reducing exposure to late payments and defaults.

-

With many Michigan companies operating on extended terms, AR risk monitoring alerts you when payment behaviors worsen.

You get signals on:Late payments

Increased debt

Collections activity

High-risk aging trends

This allows you to intervene early, tighten terms, or pause credit extension.

-

CCA updates Michigan data continuously using crowdsourced A/R contributions, verified partner data, debt collection records and real-time payment signals.

This ensures you always see the most accurate and up-to-date financial information.

-

You can search any licensed cannabis operator in Michigan, including:

Cultivators

Manufacturers

Distributors

Retailers/dispensaries

Delivery companies

Microbusinesses

Testing labs

Vertical operators

If they hold a valid state license, you can run a credit check and monitor their AR risk.

-

Yes. Yes. All data is:

Anonymized

Fully compliant

Securely processed

Never shared with competitors or the company you’re checking

CCA follows strict financial privacy and data-security standards. -

CCA aggregates data from:

AR contributions from members

Debt collection records

Historical payment performance

Industry-wide aging data (30/60/90+ days)

This gives you a complete, real-world financial picture of how cannabis companies actually pay in Michigan, not just what they claim on paper.

-

A CCA Michigan credit report includes:

Company license status

Risk rating & risk factors

Payment history and trends

30/60/90+ day aging behavior

Collections alerts and flagged debtor status

This supports faster and more confident credit decision-making.

-

Credit reports are available instantly.

Just search the operator, select the record, and view the following in real time:Risk score

Payment behavior

A/R aging

Collections activity

-

CCA helps you:

Identify high-risk cannabis companies before extending credit

Monitor customers for worsening payment behavior

Spot slow-pay/no-pay operators early

Benchmark risk across the Michigan market

Set smarter credit terms based on data

The result: fewer losses, fewer surprises, and stronger cash flow.