Cannabis Credit Checks for Illinois Operators

If you operate within Illinois’ cannabis industry and are facing unpaid invoices, delayed payments, or growing receivables, CannaBIZ Collects helps you recover outstanding balances efficiently and compliantly.

TRUSTED BY LEADING ILLINOIS CANNABIS-RELATED BUSINESSES

Why Illinois Cannabis Businesses Needs Better Credit Risk Visibility

Illinois was an early adopter of adult-use cannabis and remains one of the highest-grossing state markets. However, maturity has introduced new financial challenges across the supply chain.

Today, Illinois cannabis operators are navigating margin compression due to price competition, high tax burdens impacting cash flow, store saturation in key regions, capital constraints for small and mid-sized operators, widespread use of trade credit and extended payment terms.

With Net 30–90+ terms now common, payment behavior varies significantly between operators. Illinois-specific cannabis credit intelligence is critical to managing receivables and avoiding costly write-offs.

$215M+

ILLINOIS A/R DATA

400 +

ILLINOIS LICENSES IN OUR DATABASE

$17M+

ILLINOIS DEBT COLLECTION DATA

$2BIL+

CURRENT TOTAL DATA IN OUR PLATFORM

HOW CCA HELPS YOU CHECK WHO PAYS AND WHO DOESN’T IN ILLINOIS

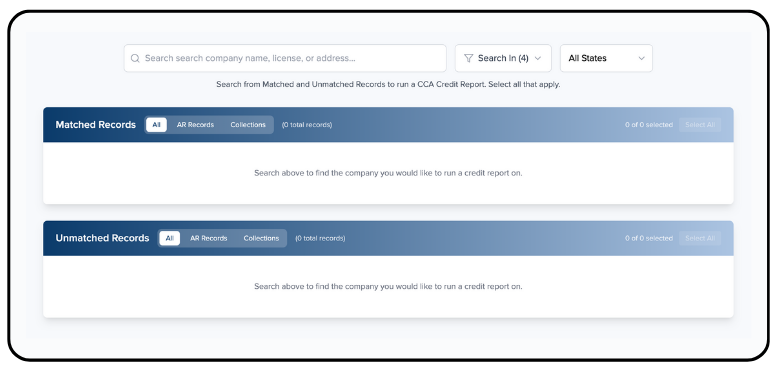

1. Search for a company to run a credit report

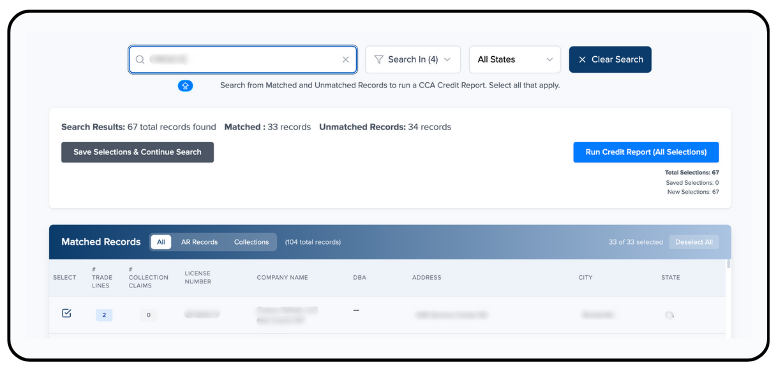

2. Select records and run the CCA report

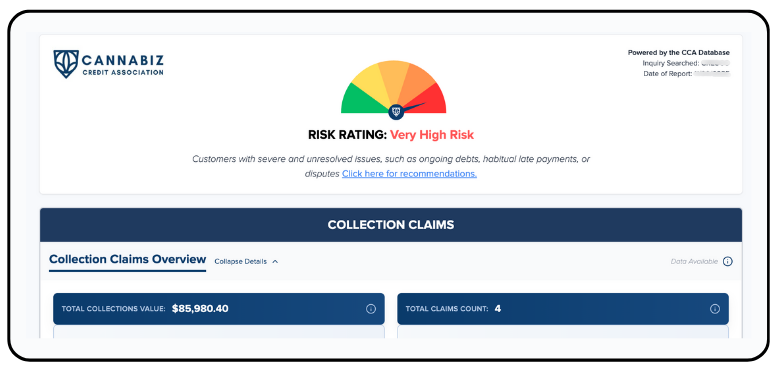

3. Check the cannabis company’s risk score

4. Review the company’s payment behavior

Why Credit Risk Is Rising in Illinois

As Illinois’ market matures, competition intensifies and access to capital tightens. Many operators rely heavily on supplier credit to maintain operations—sometimes beyond sustainable levels.

This has resulted in:

Longer payment cycles

Rising balances past due

Increased placement into collections

Irregular or selective payment behavior

Financial stress tied to license renewals and expansion

Early insight into accounts receivable risk helps suppliers, brands, and service providers adjust terms before exposure escalates.

CCA helps identify warning signs such as:

Habitual late-paying operators

License categories with elevated default risk

Accounts trending toward collections

Aging surpassing 60, 90, or 120+ days

Key Features & Benefits

Real-Time Cannabis Credit Checks

Instant access to credit data for any licensed Illinois cannabis operator.

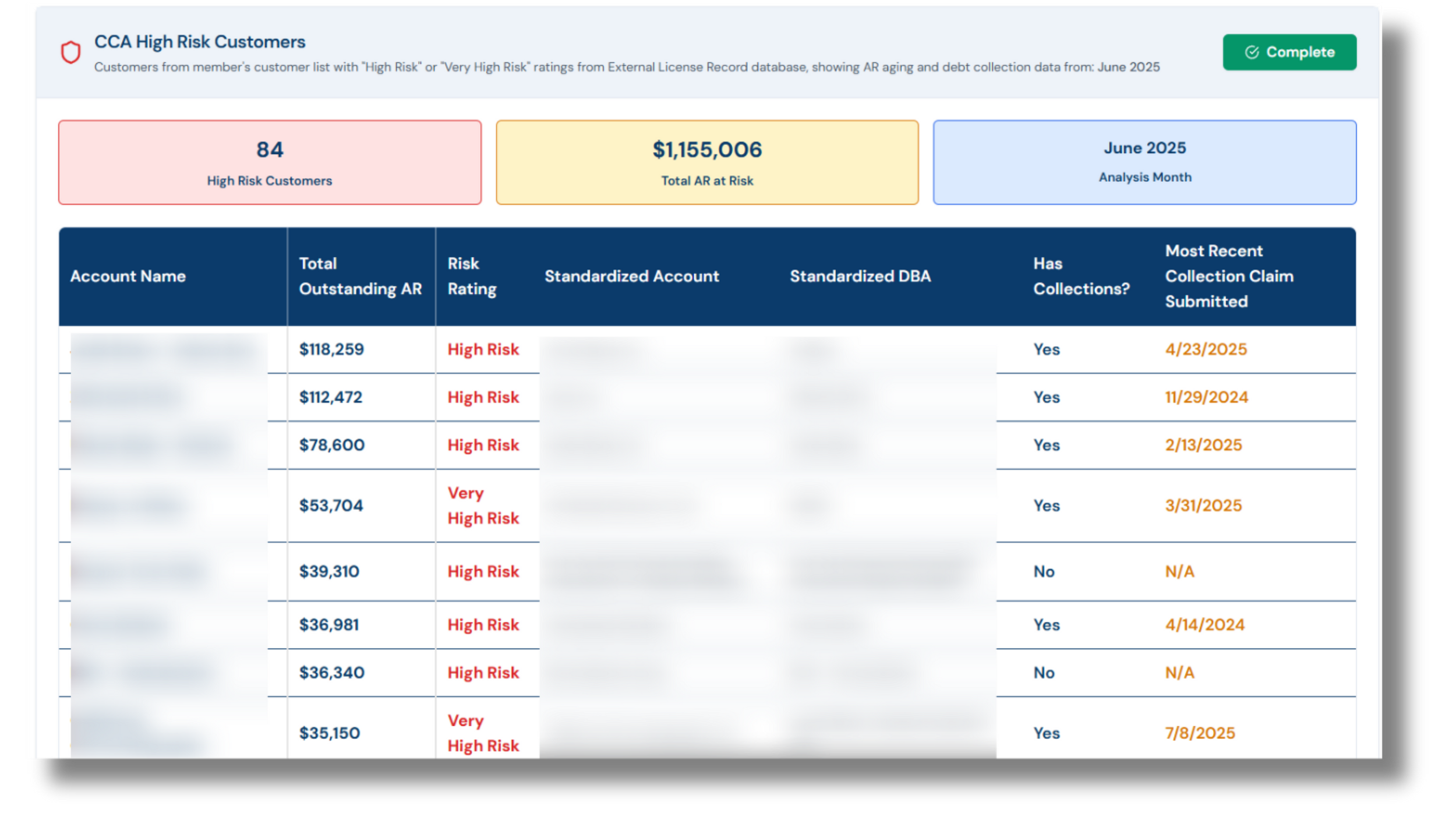

A/R Monitoring & Risk Alerts

Get notified when payment behavior changes or risk levels increase.

Illinois-Specific Credit Dataset

Crowdsourced A/R intelligence combined with verified partner and recovery data.

Risk Analysis by License Type

Dispensaries, cultivators, infusers, processors, transporters, labs, craft growers, and vertically integrated operators.

Team Access & Downloadable Reports

Unlimited users with exportable, shareable Illinois credit reports.

RUN

Credit checks on any Illinois operator.

MONITOR

Alert for flagged debtors, late pay trends, and worsening payment performance.

TRACK

30/60/90+ day aging patterns across the Illinois market.

COMPARE

Benchmark Illinois trends with national averages.

GET

React quickly to risk alerts with smarter credit limits

FAQs about the CCA and cannabis credit scoring in Illinois

-

Illinois’ tax structure, competitive dynamics, and license framework create payment patterns unique to the state. Illinois-specific data reflects actual payment history, helping you extend credit more safely.

-

Ongoing monitoring alerts you to early risk signals such as:

Aging moving into higher-risk buckets

Increasing balances with reduced payment activity

Collections or recovery placements

Lengthening payment timelines

-

Illinois data is updated continuously through:

Crowdsourced accounts receivable submissions

Verified partner contributions

Active debt recovery records

Live payment behavior indicators

-

You can search any licensed cannabis operator in Illinois, including:

Cultivators

Manufacturers

Distributors

Retailers/dispensaries

Delivery companies

Microbusinesses

Testing labs

Vertical operators

If they hold a valid state license, you can run a credit check and monitor their AR risk.

-

Yes. All data is anonymized, compliant, and securely processed. CCA does not share your AR data with competitors or the company you’re checking. The platform meets strict privacy and financial data protection standards, and no personally identifiable information is ever exposed.

-

A full snapshot of an operator’s financial reliability, including:

License status

Risk score & indicators

Payment behavior

30/60/90+ aging

Collections alerts

It’s a real-world view of how operators pay not theoretical scores.

-

Once you become a member, the CCA credit reports are available instantly. Simply search the licensed operator on the platform, and you’ll see their real-time payment behavior, risk score, and financial signals immediately.

-

CCA empowers you to:

Evaluate creditworthiness before extending terms

Monitor customers for signs of distress

Predict slow-pay/no-pay patterns

Set smarter limits

Protect cash flow with real-time risk alerts