Cannabis Credit Checks & AR Risk Monitoring for California Operators

Instant credit insights, payment history, and real‑time AR risk monitoring tailored to the California cannabis market.

TRUSTED BY LEADING CALIFORNIA CANNABIS-RELATED BUSINESSES

Why California Matters

California is the largest and most complex cannabis market in the United States. With thousands of licensees, frequent regulatory updates, high market saturation, and widespread use of trade terms, extending credit in California carries significant financial risk. Access to state‑specific credit data and payment history is critical for protecting your receivables.

$428M+

CALIFORNIA A/R DATA

2,000 +

CALIFORNIA LICENSES IN OUR DATABASE

$113M+

CALIFORNIA DEBT COLLECTION DATA

$2BIL+

CURRENT TOTAL DATA IN OUR PLATFORM

HOW CCA HELPS YOU CHECK WHO PAYS AND WHO DOESN’T IN CALIFORNIA

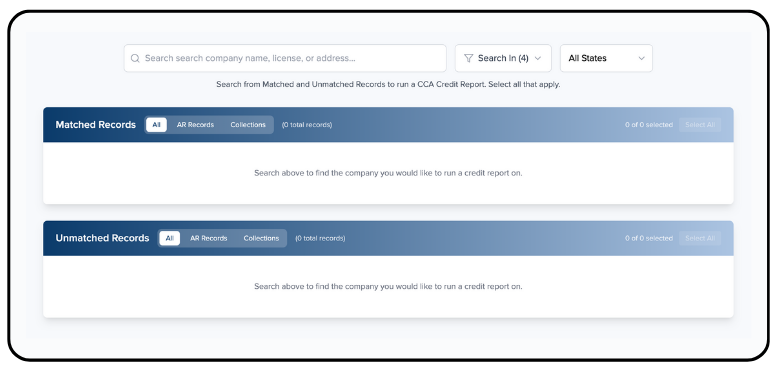

1. Search for a company to run a credit report

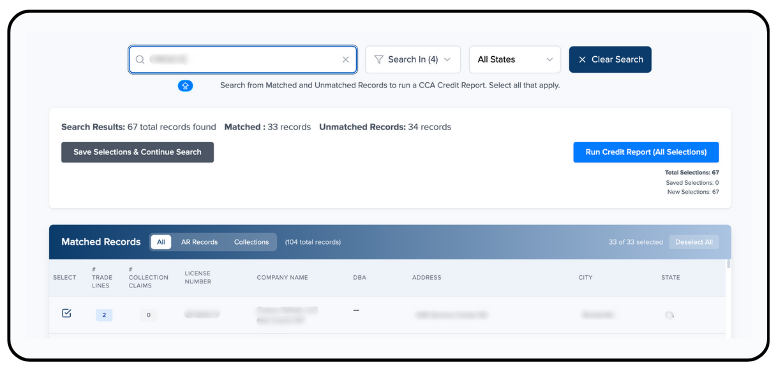

2. Select records and run the CCA report

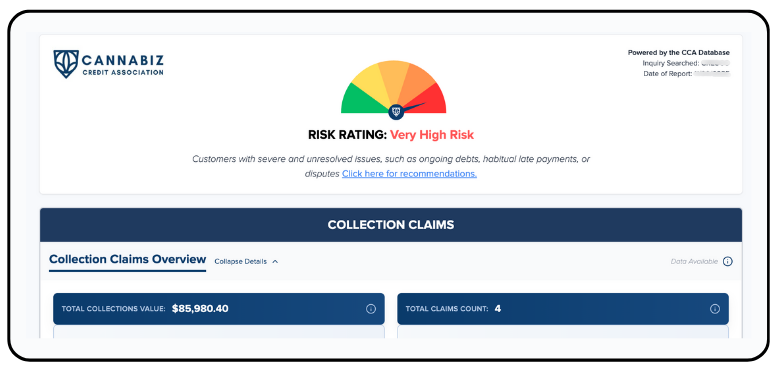

3. Check the cannabis company’s risk score

4. Review the company’s payment behavior

Why Credit Risk Is High in California

California faces ongoing volatility including price compression, tax burdens, license turnover, and illicit‑market competition—making credit risk especially challenging. Many California cannabis companies depend on extended payment terms, increasing exposure to late payments or defaults. AR monitoring identifies risk early and helps vendors protect cash flow.

Features & Benefits

Real‑time credit checks for licensed cannabis companies in California

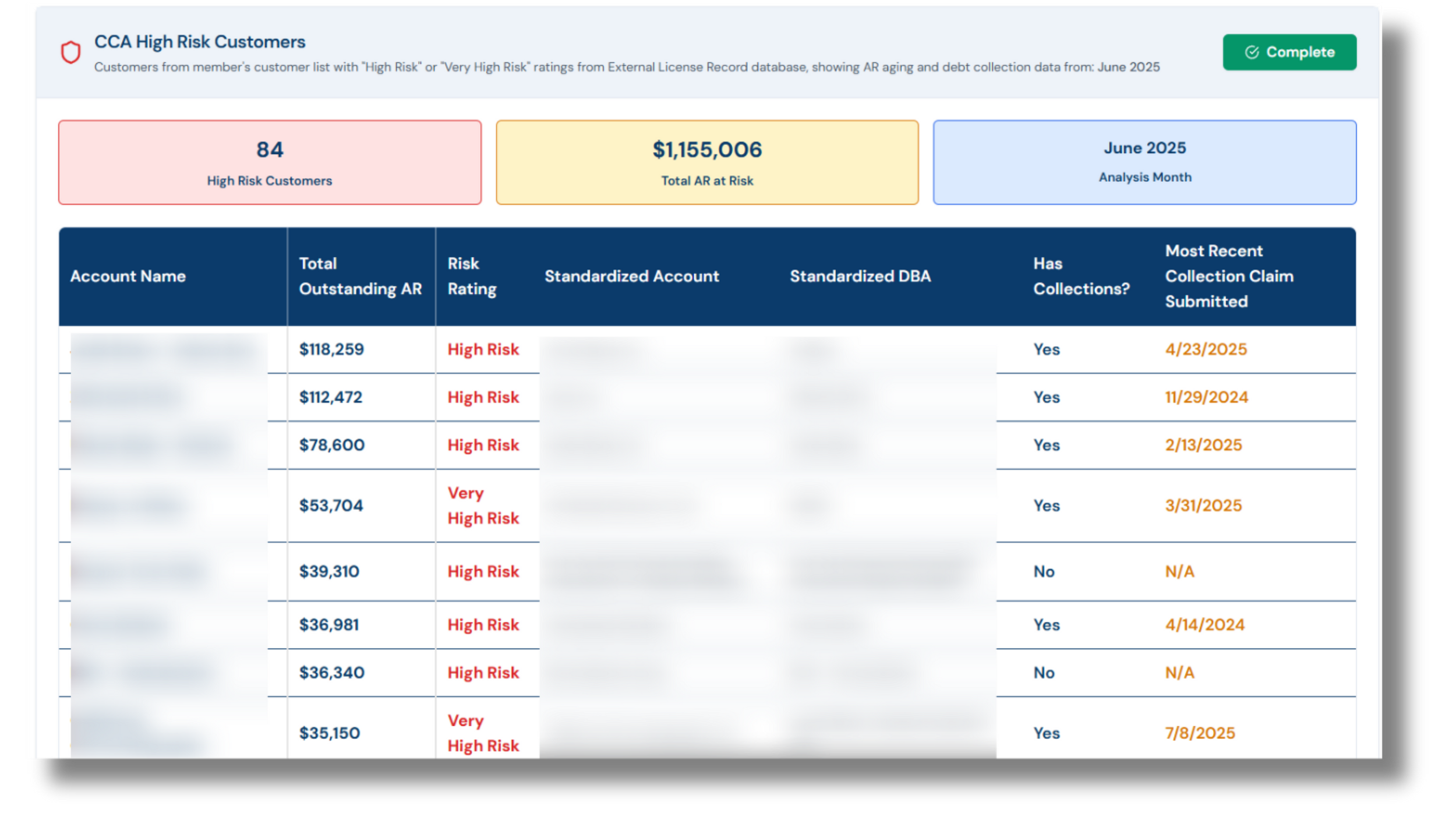

AR risk alerts and monitoring for slow‑pay or no‑pay California operators

Crowdsourced debtor data from the industry’s largest dataset

Track risk exposure by California license type (cultivator, distributor, retailer, manufacturer)

Unlimited team access and downloadable credit reports

RUN

cannabis credit checks on any licensed operator in California

MONITOR

flagged debtors and late‑payment history unique to California

TRACK

30/60/90+ day aging patterns across the California supply chain

COMPARE

Benchmark California payment behavior against national data

GET

alerts when a California operator’s payment behavior changes

FAQs about the CCA and cannabis credit scoring in California

-

California is the largest and most volatile cannabis market in the U.S. With thousands of licensed operators, rapid turnover, fluctuating wholesale prices, and heavy tax burdens, payment behavior varies widely. Running California-specific credit checks helps you understand a company’s payment history, risk level, and reliability before offering terms—protecting your business from unnecessary losses.

-

California operators often rely on extended payment terms (Net 30–90+), creating significant cash-flow risk for suppliers. AR risk monitoring alerts you when a company shows signs of late payments, increasing debt, collections activity, or unusual financial behavior. This helps you intervene early, tighten terms, or stop extending credit before the situation escalates.

-

CCA continuously updates California credit data using crowdsourced AR information, payment patterns, collection activity, and verified partner reports. New risk signals and flagged debtor updates appear in real time, ensuring you’re always working with the most accurate financial profile available.

-

You can search any licensed cannabis operator in California, including:

Cultivators

Manufacturers

Distributors

Retailers/dispensaries

Delivery companies

Microbusinesses

Testing labs

Vertical operators

If they hold a valid state license, you can run a credit check and monitor their AR risk.

-

Yes. All data is anonymized, compliant, and securely processed. CCA does not share your AR data with competitors or the company you’re checking. The platform meets strict privacy and financial data protection standards, and no personally identifiable information is ever exposed.

-

CCA aggregates data from:

AR contributions from members

Debt collection records

Historical payment performance

Industry-wide aging data (30/60/90+ days)

This gives you a complete, real-world financial picture of how cannabis companies actually pay in California, not just what they claim on paper.

-

A CCA California credit report includes:

Company license status

Risk rating & risk factors

Payment history and trends

30/60/90+ day aging behavior

Collections alerts and flagged debtor status

This supports faster and more confident credit decision-making.

-

Once you become a member, the CCA credit reports are available instantly. Simply search the licensed operator on the platform, and you’ll see their real-time payment behavior, risk score, and financial signals immediately.

-

CCA helps reduce losses by:

Identifying high-risk companies before you extend credit

Running risk monitoring to see if a customer’s payment behavior declines

Providing visibility into slow-pay/no-pay operators

Helping you benchmark risk across the California market

Giving your team the data needed to set the right terms

The result: fewer defaults, fewer surprises, and more predictable cash flow.